Carbon markets have emerged as critical instruments in the global endeavour to combat climate change, offering a platform to incentivize and reward organizations, governments, and individuals for their efforts to reduce carbon emissions. In the African context, there is immense potential to make an impact in the global carbon market which will come with the potential for transformative economic growth. As the demand for carbon credits increases globally, Africa can leverage its natural resources, reforestation, and renewable energy projects to create sustainable revenue streams. This has the potential to attract investment in green technologies, job creation, and infrastructure development, all contributing to the region’s economic prosperity. Looking ahead, Africa’s future in the carbon trading markets is promising. The global focus on sustainability and emissions reduction continues to grow, opening new opportunities for the continent.

Understanding Carbon Markets

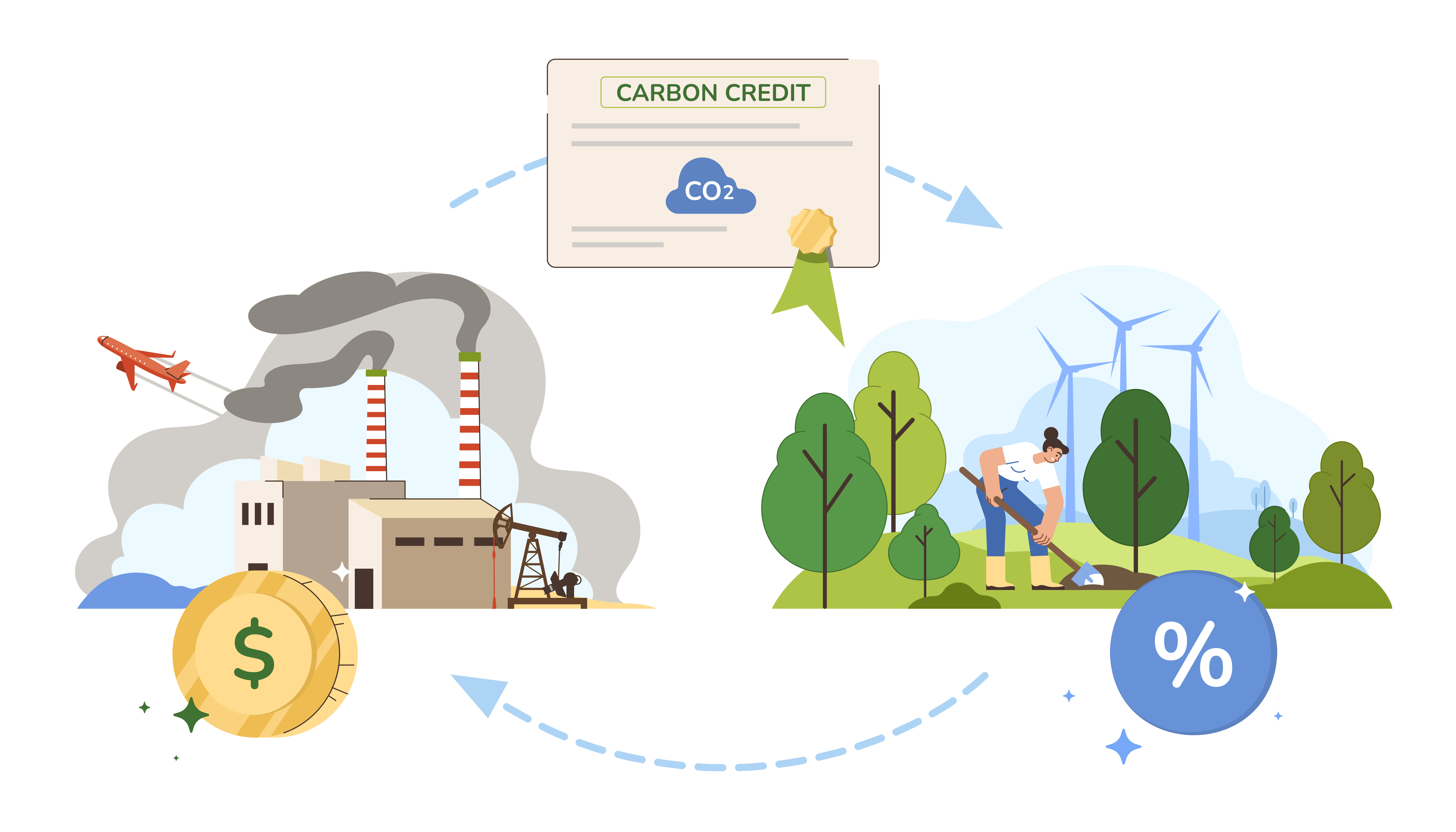

There are primarily two types of carbon markets: compliance markets and voluntary markets. Compliance markets, often known as cap-and-trade systems, are established and mandated by governments or regulatory bodies to control greenhouse gas emissions within specific regions or sectors. In these markets, emission reduction targets are set, and participants are allocated a limited number of emissions allowances or permits. If organizations exceed their allocated limits, they must either reduce their emissions or acquire additional allowances by purchasing carbon credits.

In contrast, voluntary markets are not regulated by government mandates, and participation is entirely voluntary. In these markets, organizations, and individuals can choose to offset their carbon emissions voluntarily by purchasing carbon credits or offsets. These credits are generated through various environmental initiatives, allowing participants to compensate for their emissions. The voluntary carbon market is largely driven by corporate social responsibility, sustainability goals, and a desire to enhance environmental branding.

In Africa’s carbon trading landscape, voluntary markets are the predominant force, overshadowing compliance markets. This dominance stems from the fact that many African nations are still in the early stages of formulating regulatory frameworks for carbon emissions and cap-and-trade systems, which are the hallmark of compliance markets. However, it’s important to note that the carbon trading landscape in Africa is evolving rapidly. With the burgeoning growth in carbon trading and the increasing awareness of the need for sustainable practices, regulatory frameworks in the region are maturing. This maturation process has the potential to tip the balance in favour of compliance markets as African nations continue to embrace and enforce more stringent emissions regulations.

Accruing carbon credits

One common method of accruing carbon credits is through afforestation and reforestation projects. Trees serve as effective carbon sinks, absorbing carbon dioxide (CO2) from the atmosphere during photosynthesis. Planting trees (afforestation) or restoring previously deforested areas (reforestation) generates carbon credits based on the amount of CO2 sequestered by the trees. These credits can then be sold in carbon markets, providing an economic incentive for reforestation and afforestation efforts.

Africa’s vast forest coverage presents a valuable resource in this respect, providing the continent with a distinctive opportunity to partake in the carbon trading landscape. This potential comes from both the preservation of existing forest cover and the restoration of areas previously affected by deforestation. To unlock this environmental and economic potential, Africa must embark on well-structured afforestation and reforestation projects. The foundation of these efforts rests on establishing robust baselines for carbon sequestration, coupled with the implementation of stringent monitoring and verification processes. Ultimately, enabling Africa to issue carbon credits in a more regulated and controlled manner. Some initiatives that could potentially earn Africa massive amounts in carbon credits including the Great Green Wall project and the REDD+ Programs (Reduced Emissions from Deforestation and Forest Degradation) , an initiative which many African countries, including Kenya, Ethiopia, and Ghana, have been involved in. (Reduced Emissions from Deforestation and Forest Degradation) programs.

Renewable energy sources also play a vital role in carbon credit accrual. Clean energy sources such as wind, solar, and hydroelectric power generate electricity with significantly lower greenhouse gas emissions compared to fossil fuels. Organizations that invest in renewable energy projects can accrue carbon credits based on the emissions they avoid. These credits are often generated through renewable energy certificates (RECs) or equivalent mechanisms, offering financial benefits while promoting the adoption of cleaner energy sources. For instance, a company that invests in a solar power project may receive carbon credits for the reduction in emissions resulting from the use of solar energy instead of conventional fossil fuels.

Energy efficiency initiatives present another avenue for carbon credit accrual. By improving energy efficiency within an organization, facility, or industrial process, energy consumption is reduced, resulting in lower emissions. These reductions in emissions can be converted into carbon credits and subsequently traded in carbon markets.

Methane capture projects also contribute to carbon credit generation. Methane is a potent greenhouse gas emitted from sources such as landfills, wastewater treatment plants, and agricultural operations. Capturing and destroying methane emissions prevent its release into the atmosphere, resulting in reduced emissions and, consequently, carbon credits.

In conclusion, carbon markets offer diverse opportunities for organizations and individuals to accrue carbon credits and support efforts to combat climate change. Through participation in these markets, entities can reduce their environmental impact, improve their sustainability practices, and align their goals with global efforts to mitigate greenhouse gas emissions. Whether through afforestation and reforestation, renewable energy, energy efficiency, or methane capture initiatives, carbon markets provide a vital bridge between environmental sustainability and economic benefits.