Global transition finance continued to gain momentum in 2025, as investors increased exposure to low-carbon energy, climate-themed funds delivered stronger returns, and corporate use of carbon credits reached multi-year highs. These trends are captured in the Transition Finance Tracker for the fourth quarter of 2025, published by the MSCI Institute, which offers a market-focused snapshot of how capital is responding to the low-carbon transition.

The data point to deepening engagement across global capital markets. Climate-themed public funds posted improved performance, corporate bond portfolios showed widening divergence between low-carbon and fossil-fuel exposure, and demand for carbon credits continued to rise, driven increasingly by compliance requirements alongside voluntary action. Together, the indicators suggest that transition finance is becoming more embedded in mainstream investment decisions.

Read also: How weak farm-level data is undermining global climate targets in Africa, new data shows

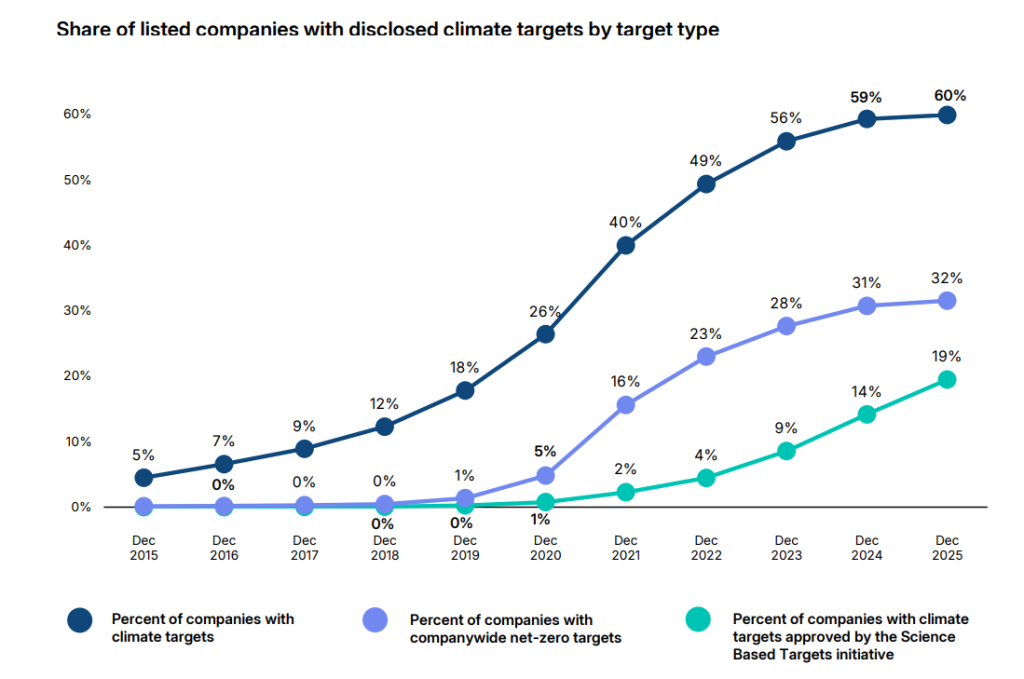

Corporate climate governance has also expanded, though unevenly. As of the end of 2025, nearly one-fifth of listed companies had climate targets validated by the Science Based Targets initiative, up from 14% a year earlier, while 32% had set net-zero targets of varying rigor. Disclosure rates have risen in parallel, with 79% of companies reporting Scope 1 and/or Scope 2 emissions and 56% disclosing at least part of their Scope 3 footprint. For investors, these metrics have become core signals of credibility and risk, even as gaps in ambition, consistency and coverage remain.

However Africa appears only faintly in this expanding picture. Beyond a single reference to South Africa in a comparative table of G20 countries’ implied temperature rise, the continent is largely absent from the analysis. Africa is otherwise folded into broad emerging-market classifications, without region-specific insights into investment flows, transition pathways or development priorities.

This limited visibility reflects more than an editorial omission. Much of the report’s underlying data is drawn from listed companies, liquid bond markets and standardized disclosures, areas where African participation remains structurally lower. In contrast, many of the continent’s transition activities are driven by project-level finance, development institutions and blended capital structures that sit outside traditional market benchmarks.

The distinction matters. While higher-income economies focus on decarbonising mature energy systems, many African countries face a dual challenge: reducing emissions while expanding access to basic services and infrastructure. Clean cooking, distributed power, climate-resilient agriculture and adaptation-focused investments are central to this transition, yet remain difficult to capture through equity indices and corporate bond analytics.

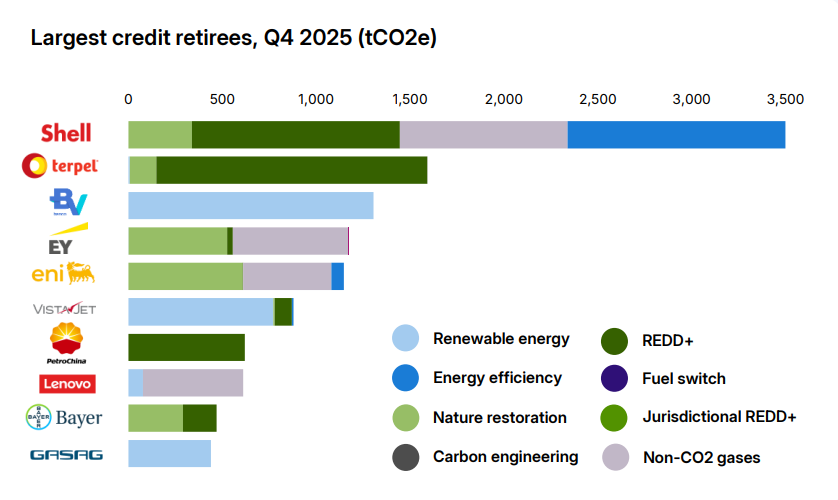

At the same time, Africa’s relevance to global climate outcomes is growing. The continent is emerging as a key supplier of carbon credits, a destination for renewable energy investment and a testing ground for finance models that link climate mitigation with development impact. Recent activity in clean cooking, aviation offsets and renewable infrastructure illustrates how global capital is beginning to intersect with household-level outcomes.

The absence of Africa from mainstream transition finance metrics therefore highlights a broader analytical gap. As investors place greater emphasis on climate alignment and real-world impact, expanding measurement frameworks to reflect regions where the transition is shaped by development realities may be essential. For now, the data show progress in global transition finance, and reveal where the picture remains incomplete.

Engage with us on LinkedIn: Africa Sustainability Matters