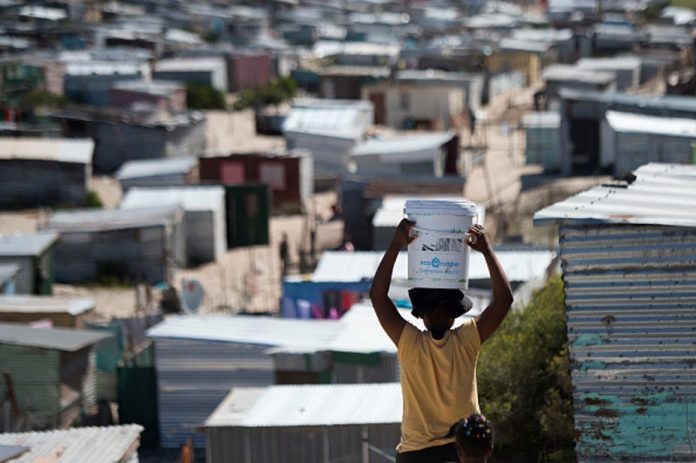

The consequences of the COVID-19 lockdown are yet to be fully determined and understood. But one thing we can be fairly certain of – in South Africa its impact will be shaped by the country’s inequalities.

Our study reveals that half of the adult population survives with near-zero savings, while 3,500 individuals own 15% of the country’s wealth. The response to the crisis must take this into account to help the most vulnerable while still safeguarding fiscal sustainability.

Based on our new study on wealth inequality in South Africa, we propose a progressive solidarity wealth tax. This would allocate the fiscal burden of current interventions on those most capable of paying. It is in line with the recommendations recently made by the International Monetary Fund to equitably attain fiscal sustainability and better position the economy for post-COVID recovery.

We show that a wealth tax on the richest 354,000 individuals could raise at least R143 billion. That equates to 29% of the announced R500bn fiscal cost of the relief package.

Unequal distribution

A lot of studies show how extreme income inequality is in South Africa, but little has been documented about wealth. Net wealth is the sum of all assets less any debts. Assets include cash, bank deposits, pensions, life insurance, property, bonds and stocks. Debt includes mortgages and other loans such as retail store credit accounts or loans from friends, family and money lenders. Read more…