By Patrick Alushula

Kenya’s monetary policy is back in the spotlight after a new report showed that the country’s foreign investment attraction ranking had stagnated comparative to its East Africa peers amid concern about rigidity in currency movement.

The Absa Africa Financial Markets Index (AFMI) 2019 showed that Kenya retained positioned three with a score of 65 out of 100 points, placing it below leader South Africa and second placed Mauritius, which added 13 points to hit 75 points.

And while Kenya stagnated, its neighbours Tanzania, Rwanda and Uganda closed their gaps by gaining 12, four and three points respectively to storm into top 10 spots. Tanzania climbed from position 15 to seven as Rwanda moved to 9th from previous year’s 11th.

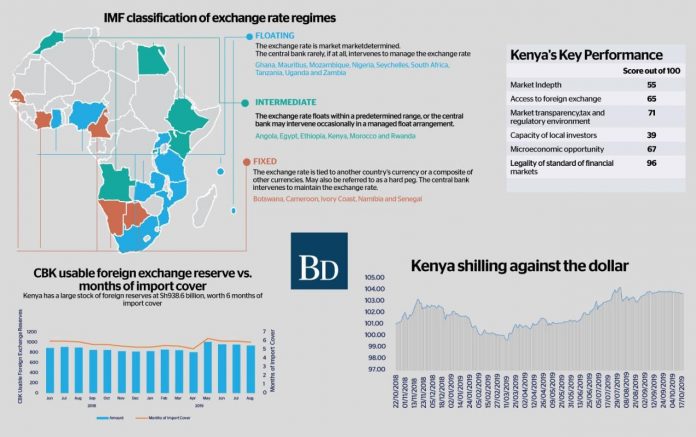

A review of the ranking showed Kenya’s woes largely stem from low sensitivity of its currency to market fundamentals — potentially pointing to interventions on currency positions by the Central Bank.

And while Kenya improved its points in five of the six pillars used in ranking the attractiveness of markets, it lost 28 points in ‘access to foreign exchange’ pillar to close with 65 points. This saw it drop from last year’s first position in this pillar to fifth, beaten by South Africa, Egypt, Uganda and Rwanda.

The AFMI 2019 report cited last year’s move by International Monetary Fund (IMF) to reclassify the Kenyan shilling from ‘floating’ to ‘other managed arrangement’ to reflect the currency’s limited movement due to periodic intervention by Central Bank of Kenya (CBK).

“Kenya drops in ranking (on forex pillar) after the IMF reclassified its exchange rate regime to ‘other managed arrangement’ from ‘floating’, a move the central bank contests,” said the report…Read more>>