By George Carew-Jones, Research Assistant in Climate Compatible Growth

Set in the towering main chamber of London’s Guildhall, the 2023 Africa Debate conference had just heard from the President of Zambia on the importance of foreign direct investment to Zambia’s growth story over the coming years. Responding to his words, a Nigerian solar energy business owner stood up: “I want to call out the European investors in the room”, she said. “We spend all our time lately filling in ESG forms trying to get or keep funding, instead of working on our business. Why does money come with more and more conditions every year? This is a new form of green colonialism!” – cue widespread applause from the conference audience.

Sitting at the side of the room that day, it struck me that she had pointed out a cruel paradox. We increasingly hear about the promise of new forms of finance for solving the world’s ills. Green finance, ESG finance, impact finance – whatever your flavour – I had assumed that these investment strategies would ultimately decrease the amount of money flowing to things we do not want, like fossil fuels, and increase it to things we do want, like solar businesses in Nigeria.

If all the processes around ESG finance were making it harder for her to access capital, though, does that not undermine the whole point of these new forms of finance? Since then, Dr Alex Money and I have been working on trying to answer that question, and we have just published our findings in a new Smith School working paper.

Read also: Impact investing risks entrenching inequality without robust oversight, Oxford study warns

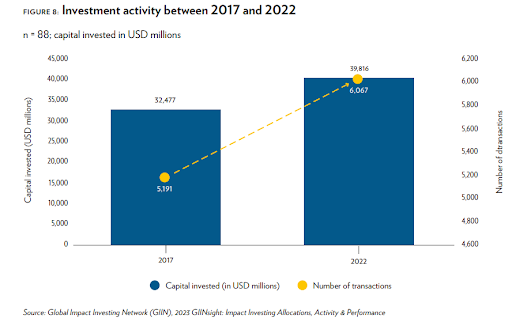

The picture is a complicated one – which is great news for an academic, less good news for everyone else! To narrow our scope a bit, we focussed on impact investment and paid particular attention to emerging markets, where data challenges are well known and where we also have good existing links with entrepreneurs and funders in Zambia. The impact investment ‘industry’ is growing rapidly and this has been associated, like many areas of sustainability, with concerns around integrity.

One story raised during our fieldwork was that of a foundation (remaining unnamed), who were promising to create 100,000 local jobs through a $50m impact fund. At $500/job it’s fair to question the definition of a ‘created job’. And this was a typical tale of impact washing.

A natural response here is to adopt the mantra that ‘measurement is management’. Ramping up checks and balances across the investment chain meets consumer demand for transparency, laying a road to integrity. Right?

If implemented well, the answer is yes. What we were more concerned with, though, was where the burden of ‘impact measurement and management’ fell. To highly simplify a 20 page paper, our core finding was that the responsibility too often lies with beneficiaries who have the least capacity, restricting capital flows to those who need it most.

Much of our fieldwork was focussed on Zambia – a country currently in the throes of 17 hour daily blackouts, resulting from a climate-induced drought suspending hydro energy generation. Few places need climate and impact finance more than Zambia. That impact measurement may pose another hurdle to accessing it is clearly problematic. But it does not have to be this way.

We also outline a few ways in our report that this impact measurement problem can be addressed, focussing on collaborative standard setting and targeted education. Standards are a way that governments can create a competitive advantage by directing impact measurement in the most productive fashion for both investors and investees – and we argue that methodological transparency is central to this. Education programmes, meanwhile, can take the form of accelerators or online courses that ultimately make venture developers bankable to investors that require certain types of impact measurement.

This all builds on work that Alex and I have been undertaking in Zambia since early 2023 on unlocking data to create opportunities for investment. We published an earlier Smith School working paper in July 2023 on Zambia’s Constituency Development Fund – a world leading set of community-developed climate adaptation projects which can be aggregated for financiers, so long as they can identify what opportunities there are and where.

The theme of both of these pieces of work can be boiled down to this: ‘no data, no deal’. The world is shifting ever further towards data-driven management. And whilst this has obvious benefits like reducing impact-washing, it also comes with hidden risks. Financial justice for emerging markets is a huge problem and one that will not be solved by more collaborative impact standards on their own. But they will certainly help demonstrate that impact investment markets are not only high integrity, but also highly effective.

Engage with us on LinkedIn: Africa Sustainability Matters